Vermonters want good public schools, fair taxes, and a say in both

Vermonters support public schools and we need property tax relief. We don’t want cuts or school consolidation forced on our communities.

Vermonters want to:

Provide immediate property tax relief for thousands of Vermonters starting this year by basing school taxes on ability to pay.

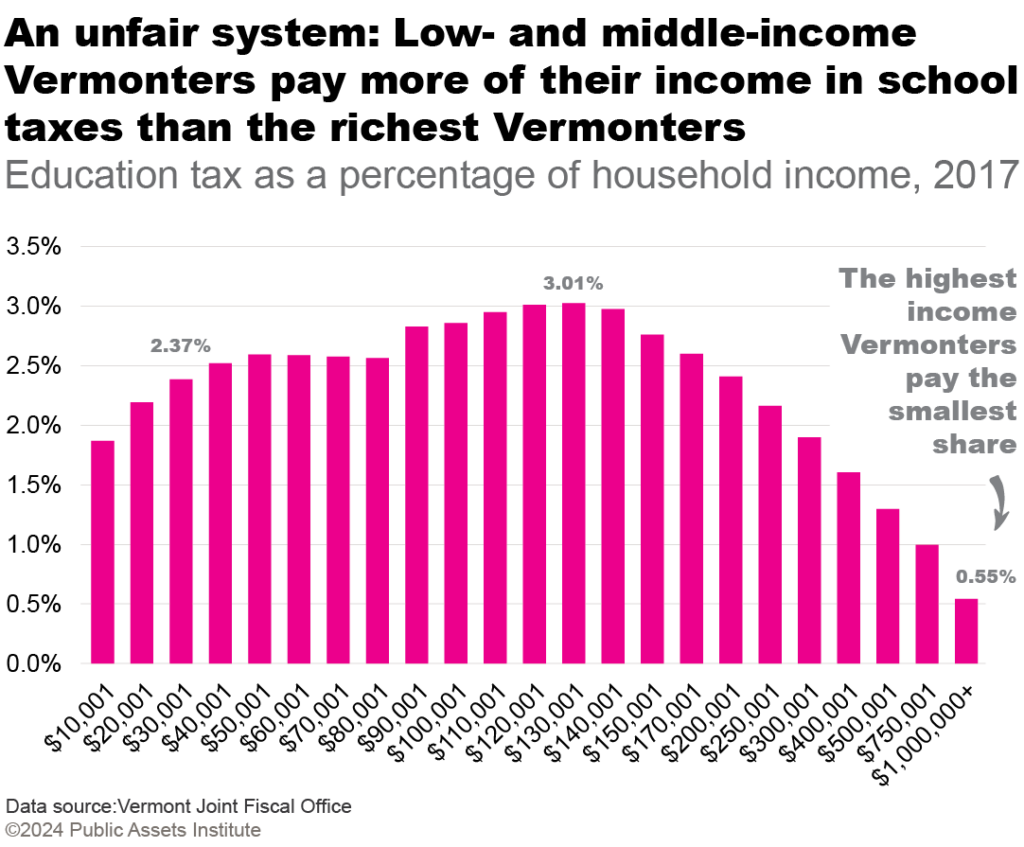

Correct the unfairness so low- and middle-income Vermonters don’t pay more than the richest Vermonters.

- Keep our public schools at the heart of our communities and our public dollars in Vermont public schools.

Legislature passes education reform bill over the objections of Vermonters

After considerable confusion and dissent, the Legislature ultimately approved the conference report of H. 454 last week with the explicit goal of spending less on public education.

As expected, the bill establishes a framework for the big structural changes to public education proposed by the governor. However, the plan leaves many critical decisions unresolved and relies on reports from unelected working groups and consultants to provide guidance for those decisions.

The first major decision is the establishment of the mega-districts this fall – the other major changes are contingent on their implementation. There will be some token opportunities for public engagement in the redistricting process, but Vermonters will have to make sure that our voices are heard at every step of the way.

There will be public meetings of the redistricting task force and the commission over the summer and fall that we’ll need to show up for. Email bekah [at] publicasset.org to get on the list for more info about where and when to weigh in.

What we know

- The bill will take away Vermonters’ votes on their school budgets. Instead of communities deciding what’s best for their kids, the plan establishes a one-size-fits-all foundation approach where Montpelier decides how much everyone spends.

- The bill doubles down on state-imposed consolidation to cut spending on schools, despite the failure of Act 46 to do exactly that.

The bill is also a do-over on other reforms that failed to achieve their intended goals: There will be a new comprehensive review of special education, following complaints about the reforms that took effect just three years ago as part of Act 173. The new system of weighting students to provide them with additional resources (Act 127 of 2022) is also being thrown out after a chaotic first year that required corrective action by the Legislature. - The bill leans into property taxes by eliminating income sensitivity in favor of a homestead exemption approach. Under this plan, low- and middle-income Vermonters will continue to pay a larger share of their income in school taxes than the highest-income taxpayers, and many will be worse off.

What we don’t know

- A redistricting task force appointed by the governor and legislature will propose up to three plans for consolidation to 10-20 mega-districts for the Legislature to vote on and have in place by July 2026.

- A voting ward working group will determine the new wards for school board elections in the new mega-districts.

- The tax commissioner will recommend a multiplier for property tax rates for second homes by 12/15/25, but the separate classification will be repealed if the Legislature fails to take action on the recommendations by 7/1/28.

- The Commission on the Future of Public Education will narrow the scope of their report to: which decisions should be local or state; necessary updates for the roles of school boards and the electorate; and a non-binding recommendation for a process for a community served by a school to have a voice in decisions about school closures. Their draft report is due by 10/1/25 for public comment, the final by 12/1/25.

- There are also a number of other reports in the bill that policymakers will use to make additional decisions with potentially long-lasting impacts on Vermont students and schools including: pre-k and childcare; transportation; the right inflation index for the foundation amount; how to determine whether schools are small or sparse by choice or necessity; how to minimize impacts and cliffs in the homestead exemption; how to fund school construction; how to oversee therapeutic schools; whether there should be a grade weight for high school; how to fund career and technical education; new graduation requirements.

The bill leaves a lot of questions unanswered and a lot of work left to do, mostly by unelected working groups and contractors. The Public Assets Education Reform Hub has more details about what’s in the bill and what’s left to be decided.

Vermonters who want a say in these decisions can start by weighing in on the development of the new mega-districts this fall. Email bekah [at] publicassets.org to get updates about the rollout of that process.

the final bill:

Includes new provisions which:

- explicitly emphasize cost-cutting over kids’ well-being no matter what it takes: forced consolidation, slashing educator jobs, reducing spending on pre-k, and special education

- include special deals to protect independent schools from potential cuts even while other schools are forced to spend less

- accelerate the timeline for implementation by one year, setting new district boundaries by July 1, 2026 and moving everything else up

And retains many of the problems from prior versions:

- doesn’t address the cost drivers outside of districts’ control like soaring health insurance costs and kids’ increasing mental health needs

- rushes major changes without analysis of the projected impacts or evaluation of actual outcomes like we saw with recent education reforms such as Act 46

- moves to a one-size-fits-all foundation amount that will force some districts to spend less, raise some towns’ taxes, and make it easier for lawmakers to cut school funding

- is anti-democratic because it takes away decision-making on school budgets from local communities

- slashes the number of school boards and school board members

- keeps the things that are frustrating about the the property tax and makes it more complicated

- imposes drastic school consolidation, which will harm communities and kids and will lead to the loss of educator jobs

- potentially reinforce barriers for kids with disabilities

- could require significant investment in new school buildings and infrastructure to meet new class size minimums

- could result in additional public money going to private schools

attend a town hall in your community!

Make your voice heard!

Gather teachers, students, parents, caregivers, and community members to meet with your local legislators to learn and share feedback about the proposed changes to public education.Upcoming Town Halls

Newport Town Hall Meeting

- Wednesday, May 21st 5:30pm-7:00pm, Email bekah[at]publicassets.org for more info.

Washington Central Town Hall Meeting

- Time and location TBD, Email bekah[at]publicassets.org for more info.

Past Town Halls

Cabot / Plainfield-Marshfield Town Hall Meeting

- Wednesday, April 30th 6:00pm-7:30pm Willey Building, Cabot Vermont.

Chittenden County Town Hall Meeting

- Wednesday, April 2nd 6:00pm-7:30pm Winooski School District Performing Arts Center, Winooski Vermont.

Bethel Area Town Hall Meeting

- Tuesday, March 25th 5:00pm-7:00pm 318 Main Street Bethel, Vermont

Northeast Kingdom Public Education Town Hall

- Thursday March 27th, 5:30-7:00pm Hazen Union School, Hardwick, Vermont

Washington County Public Education Town Hall

- Tuesday March 18th, 5:30-7:00pm Old Labor Hall, Barre, Vermont

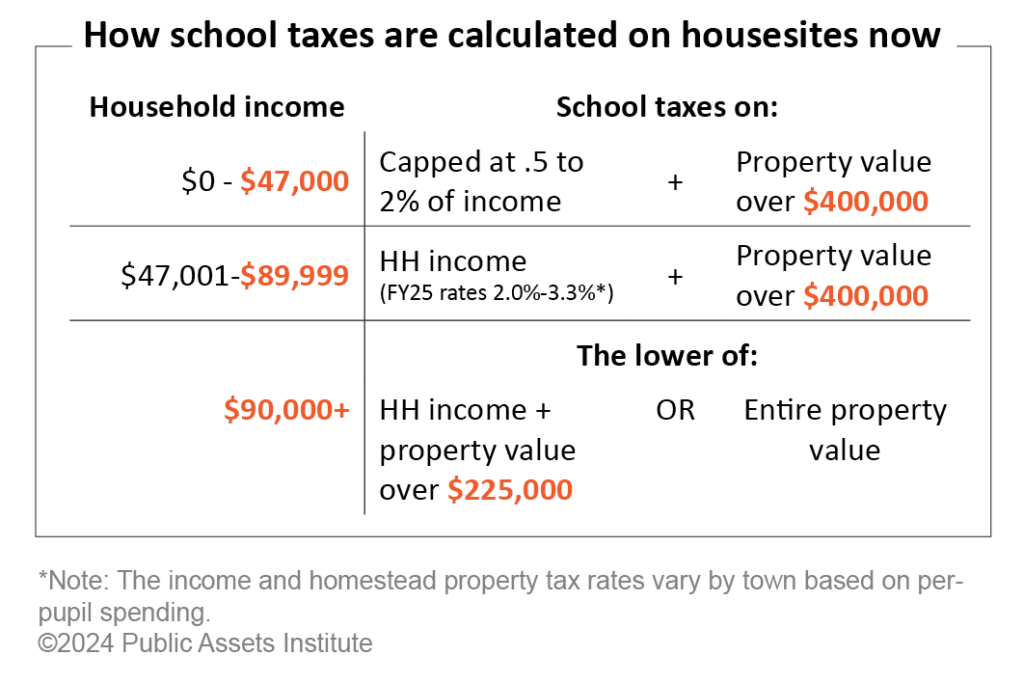

How to make school taxes fairer this year and beyond

The two most pressing problems in public education are the unfairness in who pays school taxes and the cost drivers out of schools’ control. Current proposals in Montpelier won’t solve either of these problems. We can provide immediate tax relief to thousands of Vermonters by updating income sensitivity and ultimately moving to income-based taxes. And we can address the cost drivers without slashing school budgets, forcing consolidation, or taking away Vermonters’ say in their schools.

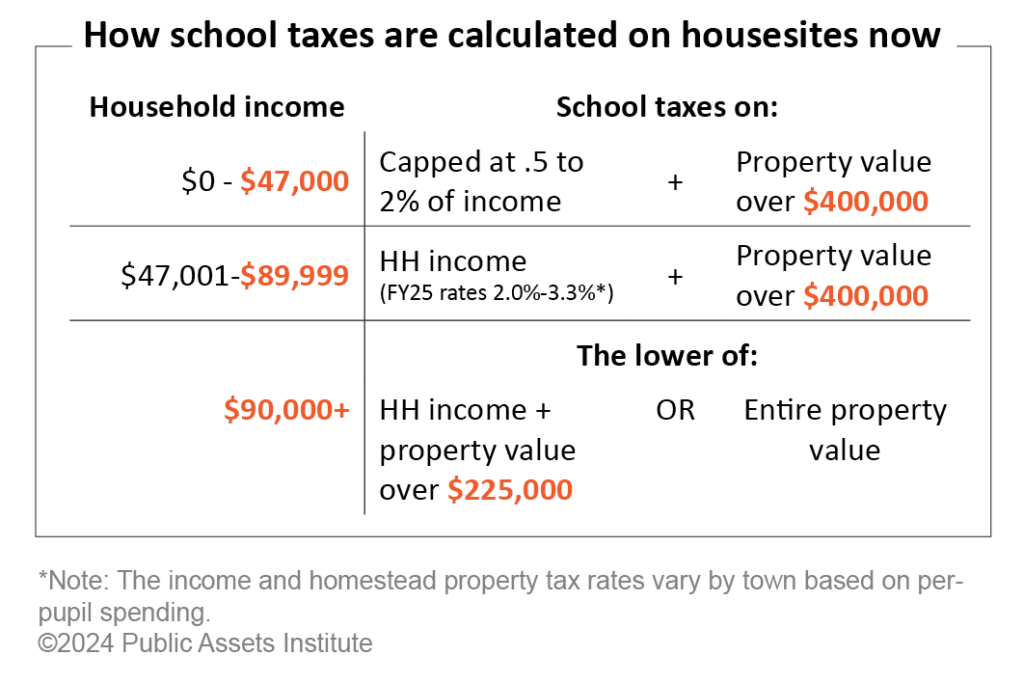

1. Income sensitivity thresholds have not been updated for decades.

More and more Vermonters pay a combination of income and property taxes. When their incomes or house values pass certain thresholds their tax bills can jump even when school spending doesn’t change. Updating the thresholds would ensure low- and middle-income Vermonters benefit from income sensitivity.

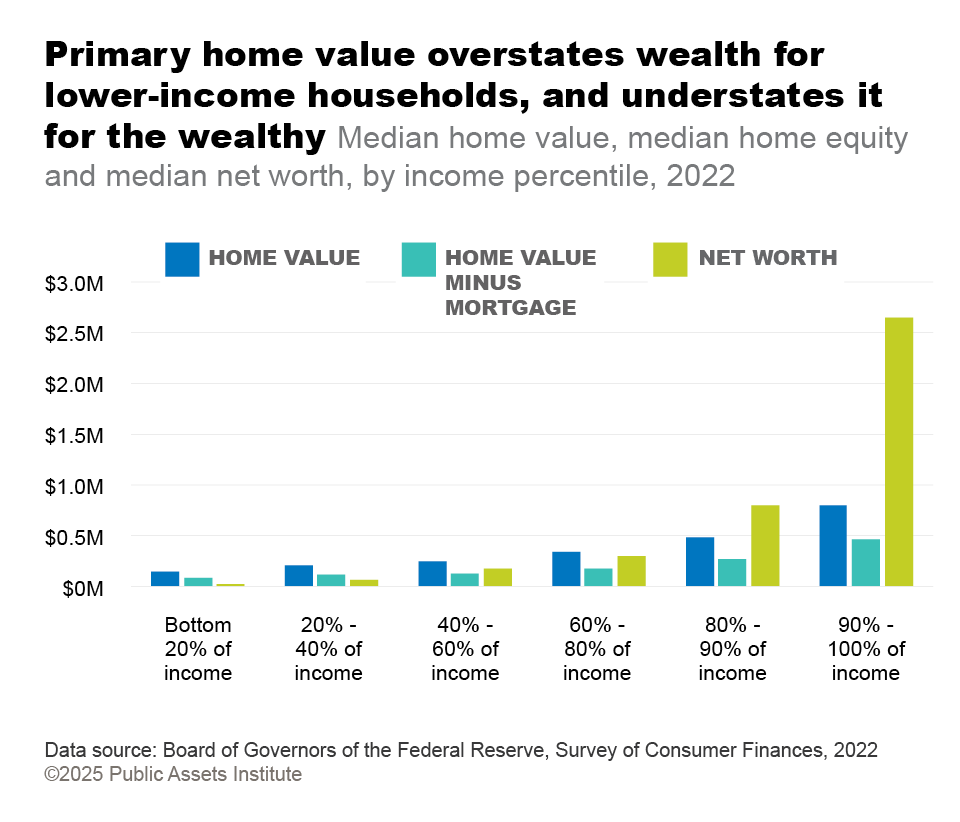

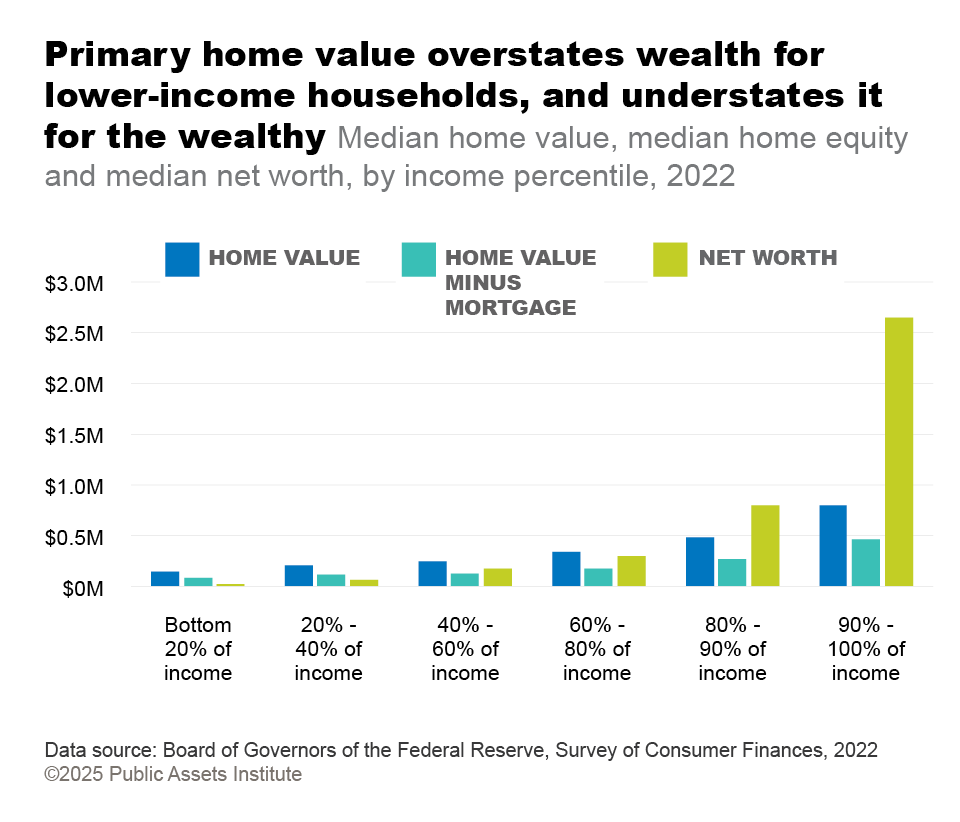

2. Income is the best measure of ability to pay according to the Vermont Tax Structure Commission.

When we first started our public education system, property—land, cows, sheep—was the best measure of Vermonters’ ability to pay. But now most Vermonters have income from jobs, and they don’t sell a cow to pay their school taxes—they pay taxes out of their income.

Click here to download a pdf copy of this information

Education spending: What's true

WHAT YOU HEAR: School spending is out of control.

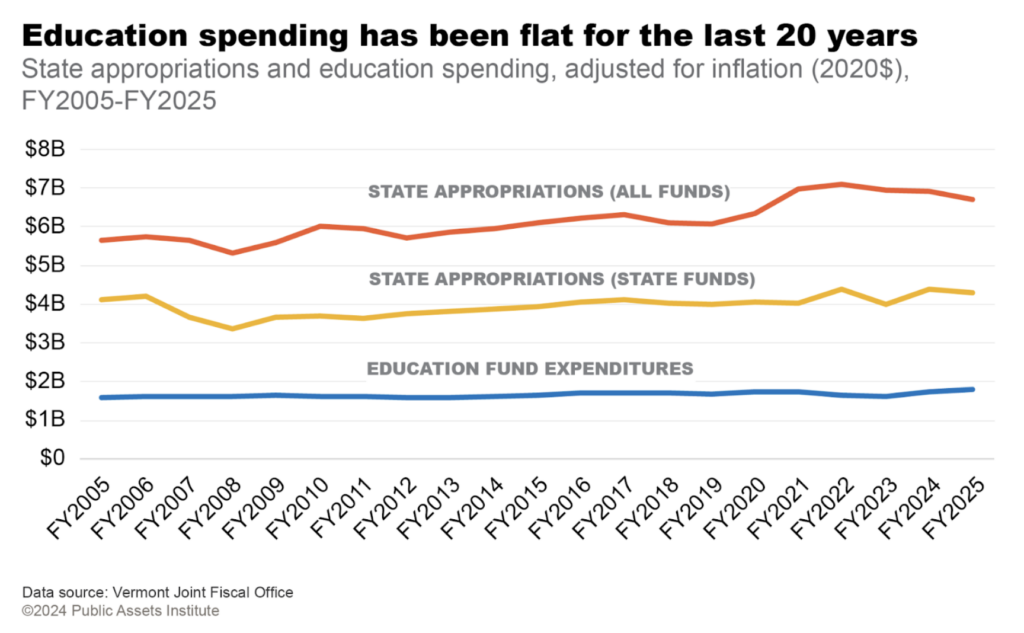

WHAT’S TRUE: Education spending has been flat for decades after adjusting for inflation, just like the rest of the state budget.

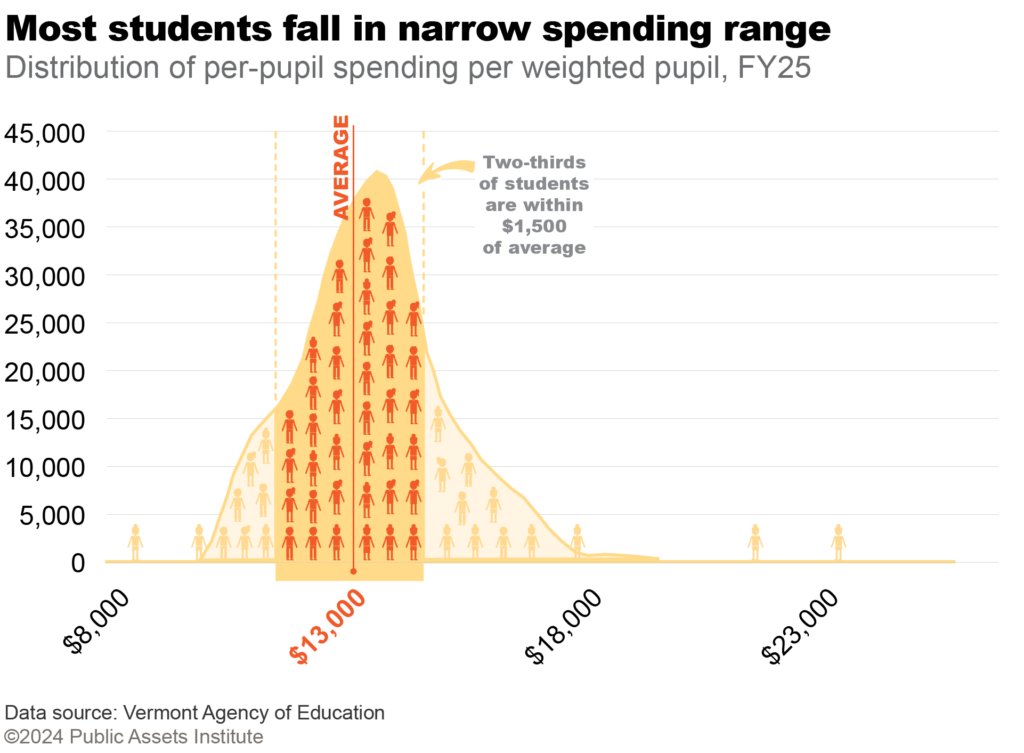

Education spending has been a consistent share of our state resources and grown at the same rate as the rest of the budget. Both education expenditures and the rest of the state budget have just kept up with inflation since 2005. Education spending did increase in FY25, driving homestead taxes up by 12.9%, but those costs were largely out of school districts’ control. In spite of these rising costs, per-pupil spending has grown less than one percent a year over the period after adjusting for inflation.

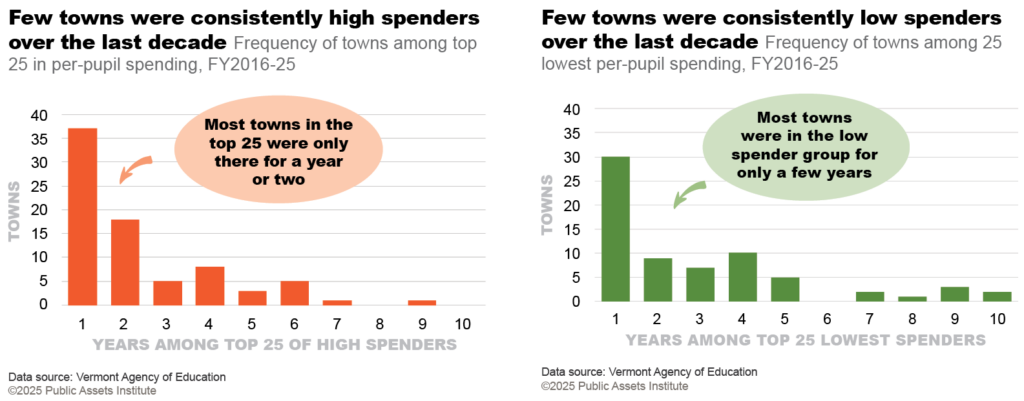

WHAT YOU HEAR: Local control is driving spending up.

WHAT’S TRUE: For most towns, much of the increase in tax bills was driven by costs outside districts’ control and increases in property values.

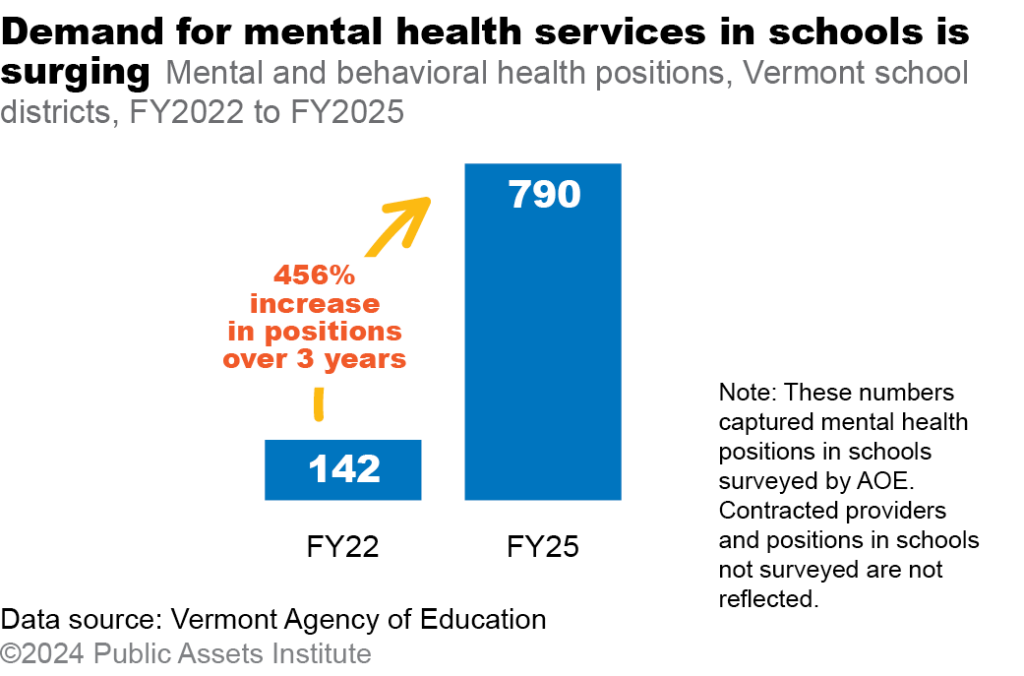

The primary cost drivers in recent years would have hit no matter how many districts we have or who decides how much to spend. The Agency of Education identified the main reasons for the FY25 spending increase: inflation; health insurance; the growing need for mental health services for students; and the loss of Covid-era federal funds. All of these pressures were unavoidable and affected other states as well as Vermont.

WHAT YOU HEAR: A state-controlled foundation system is more equitable.

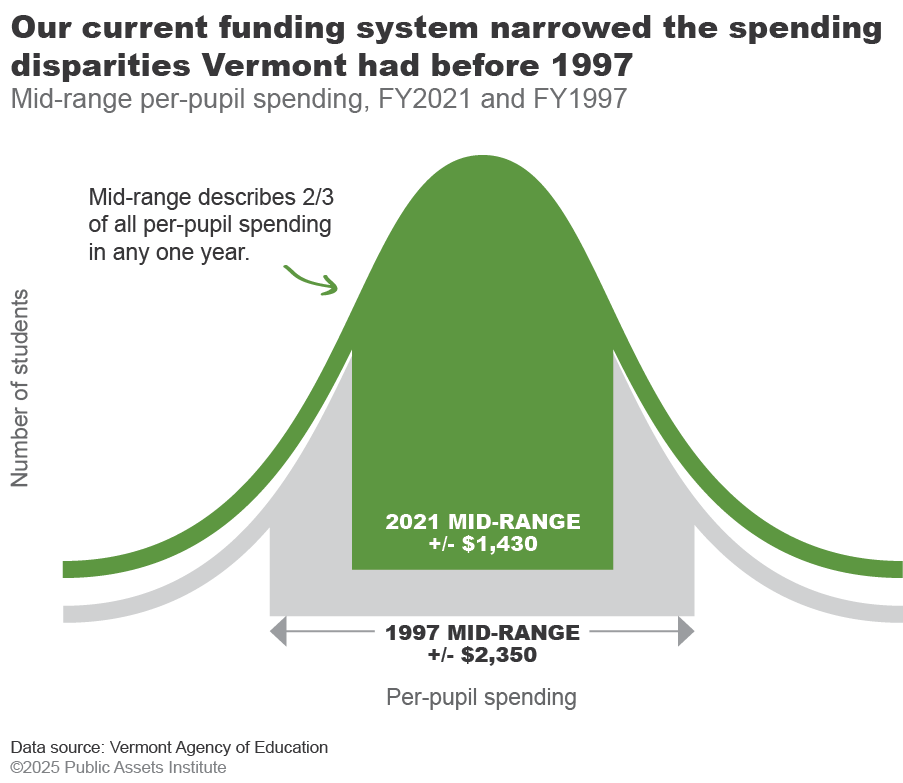

WHAT’S TRUE: Most foundation systems exacerbate inequality, including the one Vermont had before 1997.

Before the Brigham case declared the state’s foundation system unconstitutional, there were stark disparities between rich and poor towns because rich towns could raise and spend as much as they wanted above the foundation amount. The foundation amount essentially acted as a ceiling for poor towns and a floor for rich towns. In fact, the system we have now succeeded in narrowing the disparity among towns, and making things fairer for taxpayers by ensuring they get the same per-pupil spending for the same tax rate.

But even with limits on how much towns could raise above the foundation amount, there would be pressure to keep that amount as low as possible. Lawmakers in Montpelier are responsible for the entire state budget, which is complex and many steps removed from the needs of individual kids and schools. And because pre-K-12 education is the biggest thing the state does, even small tweaks to the foundation amount x80,000 kids add up to big cost savings—or big cost increases. There would be constant pressure to underfund inflationary increases or lower the foundation amount to balance the budget. And in fact, that did happen in the past in Vermont: When a portion of education funding had to be appropriated from the General Fund, lawmakers waited until the rest of the state budget was funded before deciding what to transfer for education.

WHAT YOU HEAR: People who get income sensitivity are getting a tax break.

WHAT’S TRUE: Higher-income taxpayers are the ones getting the biggest break by paying based on property value.

While income sensitivity is delivered in the form of a property tax credit, low- and middle-income Vermonters who qualify pay a greater share of their income in school taxes than higher-income Vermonters.

WHAT YOU HEAR: Local control is driving spending up.

WHAT’S TRUE: Act 46, which pushed districts to consolidate, did not have a big effect on spending.

While there has not been a comprehensive evaluation by the Agency of Education, other research has found

limited costs savings or improvement in outcomes from the mergers and raised concerns about the effects of

Act 46 mergers on communities.

What does this all add up to?

There is a lot of confusion surrounding the problems facing Vermont schools that need fixing. There are problems with who pays, and we can fix those this year. There are a lot of concerns around reading and math scores declining in the wake of the pandemic, and about cuts to arts and music and libraries that schools are already making, and we need to address them. But the biggest myth of all about school funding might be that schools can keep doing more with less. In all of the education reforms of the last decade, we’ve heard that the way to improve schools is to spend less:

- Act 46 in 2015 was supposed to improve outcomes and save money through school consolidation.

- Act 173 in 2018 was supposed to improve outcomes and save money by changing how we fund special education.

- Act 127 in 2022 was supposed to improve outcomes by providing more money for kids in weighted categories (and save money by pressuring higher-spending districts to spend less).

But we have not had good evaluation of any of those policies, in part because we haven’t really given them a chance to work before adding more changes into the mix. What limited information we have does not reflect much in the way of cost savings or improved outcomes. And now, after these major reforms of the last 10 years, we’re hearing again that a whole new system will save money and improve outcomes. But schools can’t keep being asked to do more with less. Until we commit to ensuring all kids have the resources they need to succeed, we’ll stay trapped in this cycle of myths and broken promises.

Click here to download a pdf copy of this information

Click here to download the Vermont Rural School Community Alliance Education Transformation Platform.